I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Durango Resources Inc. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Durango Resources Inc.

Durango Assays As High As 3.9 gpt Gold, 3430 gpt (110 oz/t) Silver, 8.86% Zinc and 1% Copper from Samples at Babine South, BC

Vancouver, BC / TheNewswire / February 25, 2025 – Durango Resources Inc. (TSX.V: DGO) (OTCQB: ATOXF) (Frankfurt: 86A1) (“Durango” or the “Company”) is pleased to share promising new results from exploration work on the Company’s 100% owned Babine South silver-zinc-copper exploration project located in the Babine Porphyry Belt north of Smithers, British Columbia (the “Property”).

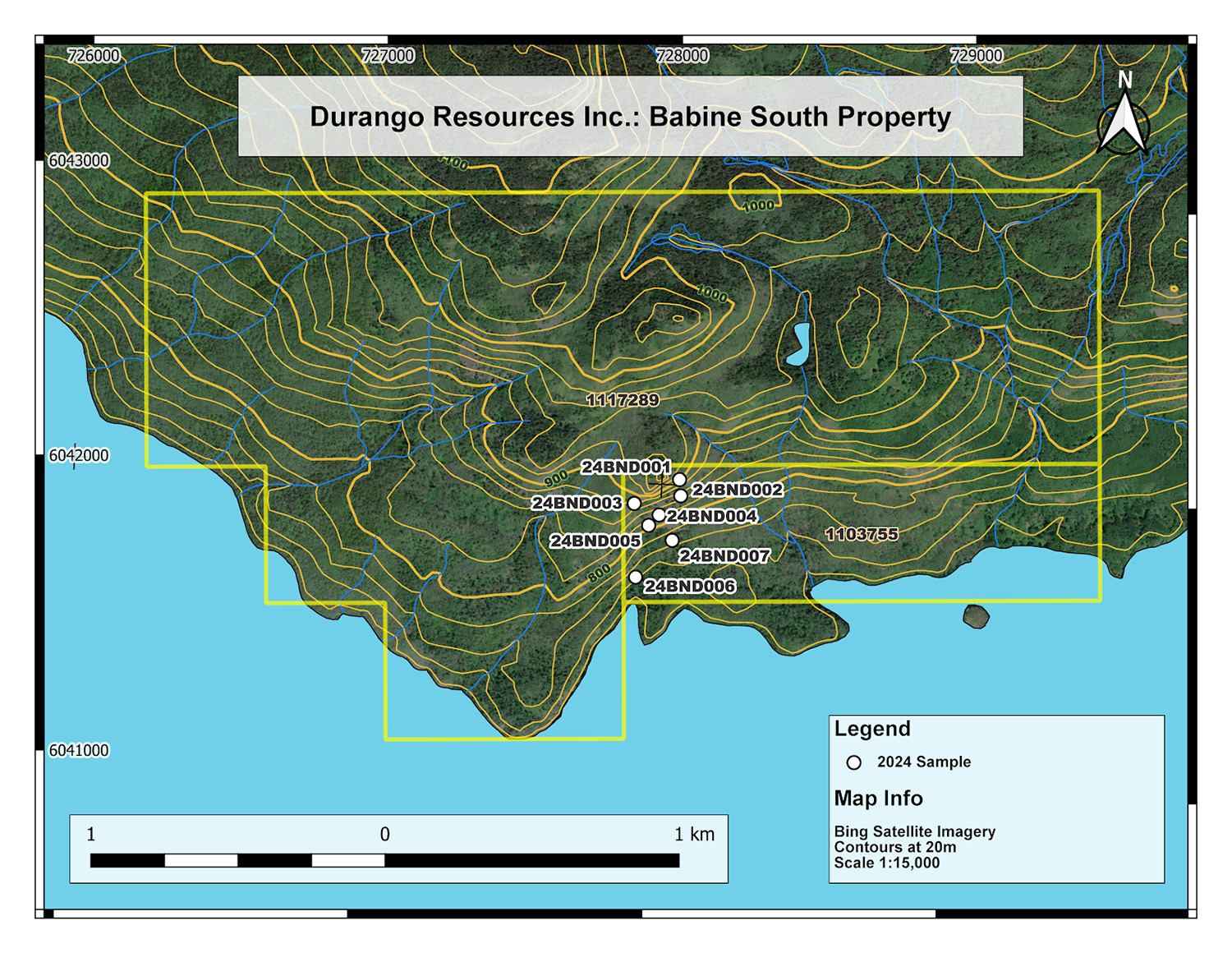

The Property covers two mineral claims, is approximately 470 hectares in size (see Figure 1), and hosts past producing silver adits from the 1920’s to 1930’s. The work history reports 94 kilograms of silver being produced from a trench, while two adits were completed to intersect the mineralization and a vein with silver rich galena was reported at 122 meters. One rock sample collected in 1991 reported 0.5% antimony along with 0.79% copper, 26.3% lead, 28.9% zinc, and 10.1 oz/t silver (Geological Assessment Report 21284).

The area is underlain by Cache Creek Group greenstone where mineralization seems to occur in quartz-carbonate veins and shears within foliated greenstone (amphibolite). Historically, the mineralization consists of argentiferous galena, sphalerite, tetrahedrite, argentite, chalcopyrite, native silver, pyrrhotite and pyrite. Tetrahedrite is an antimony rich mineral. The region also contains ultramafic rocks, such as peridotite, pyroxenite, and dunite which are rock types that can host nickel and platinum group element (“PGE”) mineralization.

Figure 1. Location of Durango’s Babine South Property Sampling

Babine South Sampling Program

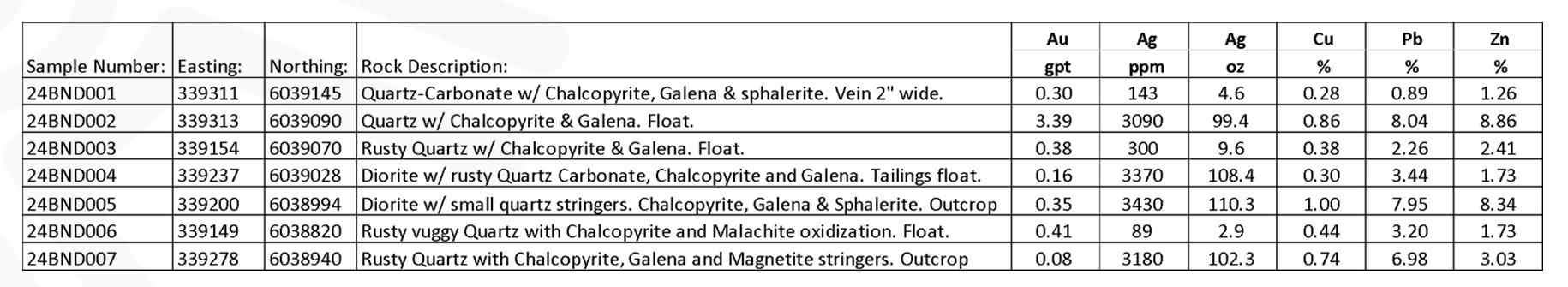

A field mapping and sampling program was completed in the fall of 2024 and seven (7) samples were collected from outcrop and float/scree in this program. The sampling included returns as high as 3.39 grams per ton (“gpt”) gold, 1% copper, 3430 gpt or 110.3 oz/t silver, 8.04% lead, and 8.86% zinc.

Samples underwent fire assay and ICP-OES and/or ICP-MS multi-element analysis. Table 1 below summarizes sample locations, lithology and assays. The sampling program was concentrated in the southern portion of the claim and the claim boundary has been expanded to the north since the surface sampling program was completed. Marked as white dots on Figure 1, all samples returned anomalous results from Babine South as detailed below:

- 24END001 – Quartz carbonate w chalcopyrite & galena (outcrop) – 143 gpt or 4.6 oz/t Ag, 0.28% Cu, 0.89% Pb, 1.26% Zn

- 24END002 – Quartz w chalcopyrite (float) – 3.39 gpt Au, 3090 gpt or 99.4 oz/t Ag, 0.86% Cu, 8.04% Pb, 8.86% Zn

- 24END003 – Rusty quartz w chalcopyrite & galena (float) – 300 gpt or 9.6 oz/t Ag, 0.38% Cu, 2.26% Pb, 2.41% Cu

- 24END004 – Diorite w rusty quartz carbonate (tailings float) – 3370 gpt or 108.4 oz/t Ag, 0.3% Cu, 3.44% Pb, 1.73% Zn

- 24END005 – Diorite w small quartz stringers (outcrop) – 3430 gpt or 110.3 oz/t Ag, 1% Cu, 7.95% Pb, 8.34% Zn

- 24END006 – Rusty vuggy quartz with chalcopyrite (float) – 89 gpt or 2.9 oz/t Ag, 0.44% Cu, 3.20 Pb, 1.73% Zn

- 24END007 – Rusty quartz with chalcopyrite (outcrop) – 3180 gpt or 102.3 oz/t Ag, 0.74% Cu, 6.98% Pb, 3.03% Zn

Table 1. Babine South field rock samples assay summary

Full assay results can be reviewed on our website at: Durango Resources Inc. - Babine Copper Projects

Geological and Technical Interpretations and Future Plans

The Company believes that the exceptional silver grades at Babine South indicate the potential for an epithermal polymetallic deposit. These deposits form when hot, acidic fluids from volcanic activity mix with groundwater at shallow depths, leading to the concentration of valuable minerals. Epithermal deposits are known for their high silver grades and are often associated with gold, lead, zinc, and copper, enhancing their economic potential.

The Company now has several options at its disposal to advance the project. These include:

- Complete detailed surface geological mapping, trenching, and/or sampling.

- Locate historic adits and complete additional and detailed sampling and/or trenching.

- Backpack drill identified areas of interest.

Marcy Kiesman, CEO of Durango Resources, commented, “We are pleased with these positive results, which appear to complement the historical work completed on the Babine South property. The findings suggest that Babine South may also host a PGE-style mineralized system, aligning well with our focus on critical metals. With the increasing global demand for gold, silver, zinc, and copper, we believe this project holds promising potential for our shareholders.”

About the Babine South Silver Zinc Project

Durango’s Babine South property covers two mineral claims and is approximately 470 hectares. The geology of the Babine South project area includes phyllite, marble and dioritic and monzonitic volcanic rocks. The region also includes ultramafic rocks, such as peridotite, pyroxenite, and dunite which are rock types that can host nickel and PGE mineralization. Four phases of veining run through the area and are cross cutting. The deposit is thought to be epithermal however historically there was some association of the veining with the foliation and shear zones. Mineralization includes quartz-carbonate veins including native silver, galena, sphalerite, tetrahedrite, argentite, chalcopyrite. MINFILE Mineral Inventory

For more information on the Company’s entire Babine portfolio, please visit: https://durangoresourcesinc.com/projects/babine-copper-projects/

About Silver

Silver is a versatile precious metal renowned for its extensive industrial applications and investment appeal. Its exceptional electrical and thermal conductivity make it indispensable in various sectors, including electronics, solar energy, and medical devices. In electronics, silver is utilized in components such as multi-layer ceramic capacitors and membrane switches, while its antimicrobial properties are leveraged in medical equipment. The solar energy industry heavily relies on silver for photovoltaic cells, with demand from this sector accounting for approximately 15% of the metal’s total usage in 2023.

The silver market has experienced notable growth, with prices increasing by over 35% in 2024, reaching levels not seen since December 2012. This surge is attributed to factors such as China’s significant economic stimulus measures and a robust bull run in gold prices. Analysts project that silver prices could rise further, potentially reaching $35 to $38 USD per ounce in the coming months. Despite potential risks, including fluctuations in industrial demand and economic growth, silver’s unique properties and diverse applications position it as a metal with a promising outlook.

Sources:

About Zinc

Zinc is a critical mineral essential for galvanizing steel, producing alloys, batteries, and supporting renewable energy technologies. Recognizing its importance, both Canada and the United States have classified zinc as a critical mineral due to its role in infrastructure, manufacturing, and national security. The global zinc market has faced supply challenges, with the International Lead and Zinc Study Group (ILZSG) reporting a 164,000-ton supply deficit in 2024 due to declining mine output and production constraints. However, forecasts for 2025 indicate a potential shift to surplus as mining operations ramp up and new projects come online. The zinc market is projected to grow from $28.82 billion in 2024 to $31.15 billion in 2025, reflecting an 8.1% CAGR, driven by increasing demand in construction, automotive, and clean energy sectors.

Geopolitical factors significantly impact zinc supply chains. China, Australia, and Peru dominate global zinc production, while disruptions such as sanctions on Russia’s Ozernoye mine and trade tariffs have contributed to market volatility. Meanwhile, investment in zinc recycling is expected to grow as industries seek to reduce dependence on primary production. As infrastructure expansion, electric vehicle production, and green energy adoption accelerate, securing stable and diversified zinc supplies remains a top priority for governments and industries worldwide.

Sources:

- U.S. Geological Survey Critical Minerals List

- Canada’s Critical Minerals Strategy

- Zinc Supply Deficit and Market Forecast

- Zinc Market Growth and Future Outlook

- Impact of Sanctions on Zinc Supply

About Copper

Copper is a critical metal essential to modern infrastructure and technology, playing a vital role in electrical grids, renewable energy systems, electric vehicles, and telecommunications. Recognizing its importance, both Canada and the United States have designated copper as a critical mineral, underscoring its significance to economic and national security.

The global copper market is poised for significant growth, driven by the accelerating transition to green energy and the electrification of transportation. Industry experts project a 3% increase in global mine output in 2025, supported by strategic capacity expansions in key mining regions such as Chile and the Democratic Republic of Congo. However, supply constraints persist due to limited new mining projects and regulatory challenges, underscoring the need for enhanced recycling efforts. Notably, copper production from scrap is expected to grow at a compound annual growth rate (CAGR) of 4.2% over the next decade, outpacing the 2.1% CAGR of primary production.

Geopolitical factors further influence the copper market. China’s substantial investments in the Democratic Republic of Congo have solidified its position as a major copper supplier, with 36.7% of China’s copper imports sourced from the DRC in 2024. Additionally, trade policies, such as potential U.S. import tariffs on copper, could impact global pricing and supply chains, leading to market volatility.

Given copper’s indispensable role in the energy transition and technological advancement, securing a stable and sustainable supply is paramount. This involves not only expanding mining activities but also investing in recycling and exploring alternative sources to meet the escalating demand.

Sources:

- Canada’s Critical Minerals

- Global Copper Market Outlook 2025

- A Guide to Copper Scrap Prices and Global Market Trends in 2025

- Congo Emerges as China’s Strategic Copper Supplier

- Tariff Threat Opens Up Transatlantic Rift in Copper Pricing

About Critical Metals

Critical metals are essential components in modern technologies, including renewable energy systems, defense applications, and advanced electronics. Both the United States and Canada have identified specific lists of critical minerals vital to their economic and national security. The U.S. Geological Survey’s 2022 list includes 50 critical minerals, while Canada in 2024 has designated 34 minerals as critical.

Recent geopolitical developments have heightened concerns over the supply chain security of these critical metals. China, which holds a dominant position in the production and processing of several critical minerals, has implemented export bans affecting the West. These actions underscore the strategic importance of diversifying supply chains and developing domestic sources for critical metals to mitigate geo-political risks and ensure the stability of essential industries.

Assay QA/QC

Rock samples were collected from the field and placed in geological plastic bags. Samples were shipped to AGAT Laboratories in Calgary. Samples were analysed for gold via fire assay and AAS finish and elemental analysis using sodium peroxide fusion with ICP-OES/MS finish. Fire assay was completed at AGAT Laboratories in Thunder Bay Ontario and multi-element analysis was completed at AGAT Laboratories in Calgary. AGAT Laboratories is accredited for ISO/IEC 17025:2017 General requirements for the competence of testing and calibration laboratories for for gold fire assay with Atomic Absorption Spectroscopy finish and mineral assaying with sodium peroxide fusion and ICP-OES/MS for all elements assayed except silver.

QA/QC measures included collection and analysis of duplicate field samples and round robin testing at a secondary laboratory for silver for select samples. All QAQC samples were reviewed by project geologist Melanie Mackay PGeo.

Melanie Mackay, PGeo, EGBC (Engineers and Geoscientists British Columbia) 35256, APEGA (Association of Professional Engineers and Geoscientists of Alberta 305012), is a director and qualified person for Durango and approves the technical content of this news release. None of the historical information in the release has yet been verified by the Company and should not be relied upon.

About Durango

Durango Resources Inc. (TSX.V: DGO) (OTCQB: ATOXF) (Frankfurt: 86A1) is a Canadian exploration company focused on advancing critical metals projects to support the West’s growing demand for secure and sustainable mineral supply. The Company holds a 100% interest in multiple strategically located properties, including the NMX East Gallium & Critical Metals Project near the Whabouchi lithium deposit in Québec, as well as claims in the Babine Copper-Gold Porphyry District and Troilus Gold Camp. With an experienced management and technical team, Durango is committed to unlocking new mineral discoveries and contributing to Canada’s critical minerals strategy.

For further information on Durango, please visit www.durangoresourcesinc.com and www.sedarplus.com.

Marcy Kiesman, CEO

Telephone: 604.428.2900 or 604.339.2243

Email: durangoresourcesinc@gmail.com

Website: www.durangoresourcesinc.com

Forward-Looking Statements

This news release contains “forward‐looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, statements that address the upcoming work programs, and other statements relating to the business, financial and technical prospects of the Company. All statements in this news release, other than statements of historical facts that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including those filed under the Company’s profile on SEDAR at www.sedar.com. Factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.